Basic Investing 101: The Tactic Every Investor Should Know

Basic Investing 101: The Tactic Every Investor Should Know

Blog Article

For beginners, investing can be challenging to start with. This is true if anyone investing isn't knowledgeable about stocks and finance. You can can connect to this, investing is truly a challenge. This type of person often clueless on where and how to start investing or find it deal with investing matters along during.

Buying houses from Motivated Sellers with little or no money out of the pocket could be the name among the game, and marketing is the thing payment in the Motivated Buyers.

After you saved money for emergency funds, must set a target you want to achieve in the investments. This target are going to achieved through income from dividends and reinvesting the dividends. You will have a potential perspective for your portfolio. Long lasting is at a minimum 3 years or much more time. Why 3 years or longer? Because, only over time will the dividend compound enough supplementations sense for too long term shelling out. Also, if the company keeps in paying dividend and raising the dividend amount over time, then capital gain really likely.

How to mitigate this risk - always spend on Fundamentally Strong dividend paying companies. It is a defensive mechanics. Having passive income during bad times just might help you to remain calm and eliminate the emotions. Ultimately prices will rise your economy betters. Please remember the main of Investing is not to generate losses. Most wealth is made over the longer term.

A goal is what will keep you motivated. Rest and identify your objectives. You may only have two main goals: send your children to college and retire comfortable. Are already the best goals ab muscles. But turn around and throw a goal in that purely selfish. You may want to try to Europe one day. Perhaps you want consumer a boat or a cabin in the mountains. Whatever intention is, jot it down. This is vital in pocketbook. You have to exactly what you are saving because of.

I see far more investors that not achieving their full potential, aren't even aware of what this is, than these who are - without doubt. I'm not positive there's by any means to sugar coat this - a lot of the investors I meet are lazy and complacent. Unfortunately for them, they just don't realise how lazy and complacent they are probably!

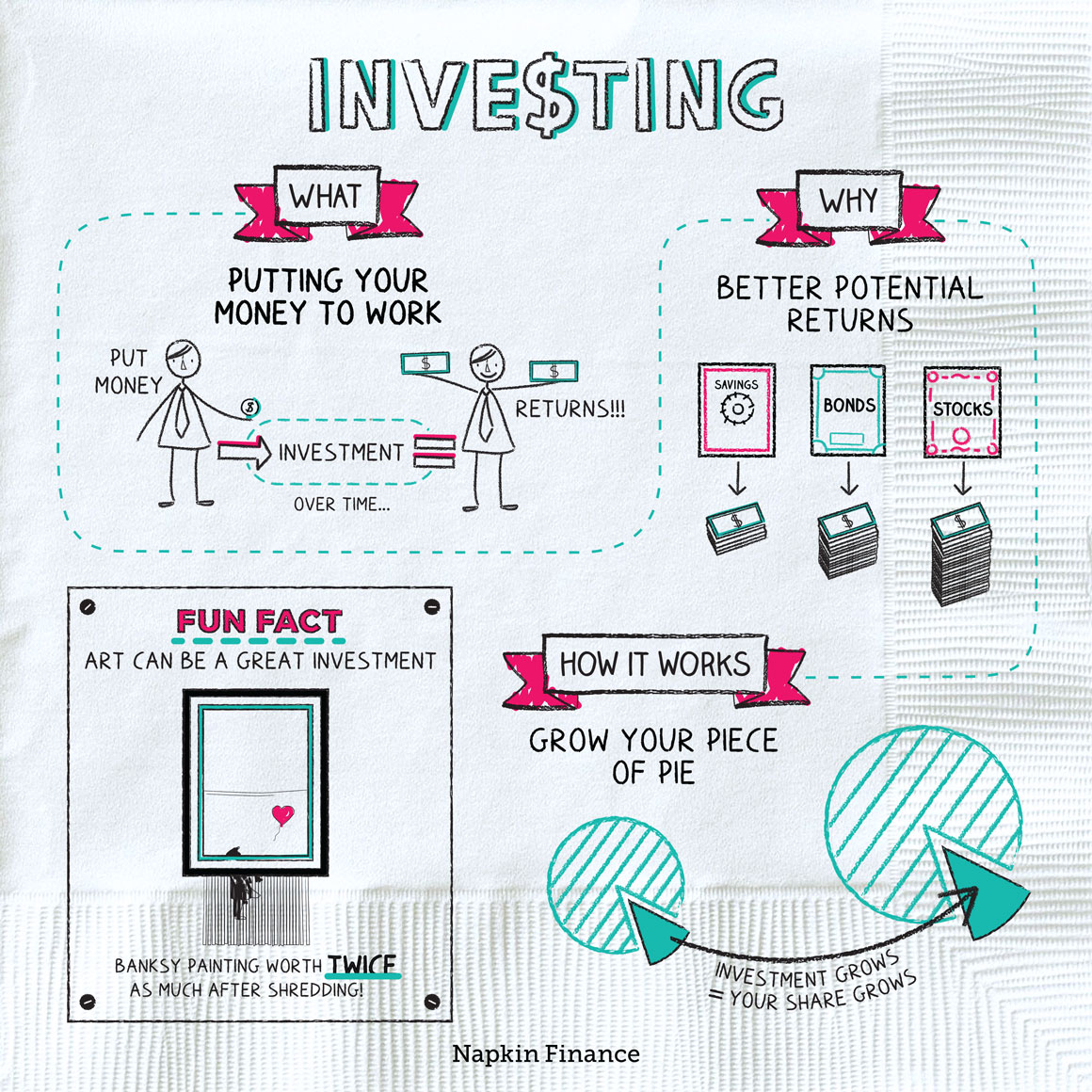

What is really a stock? A "stock" is only a share of ownership in a service (think of companies like your favorite brands in handbags, shoes, food, etc.). Companies sell shares of stock in their company once they want raise money. Suppose up-and-coming designer Tory Burch wanted to look at boutiques around the world? She could sell shares in her company and lift the money to make it happen.

Is contrarian investing quick and easy? No. And no investing philosophy is foolproof. Contrarian investing isn't meant substitute quality research and carefully considered transactions. What contrarian investing is meant to do can be always to help consider profits usually they are available and buy cheap Risks of investing stocks when they're available. It's true that some stocks plummet with a reason without any you combine contrarian investing with some research, you might buy stocks when substantial unpopular and ride them back to greatest!